The products that are included have all achieved certification under the RIAA Responsible Investment Certification program. This means they have applied a responsible or ethical strategy and have been verified as doing what they say.

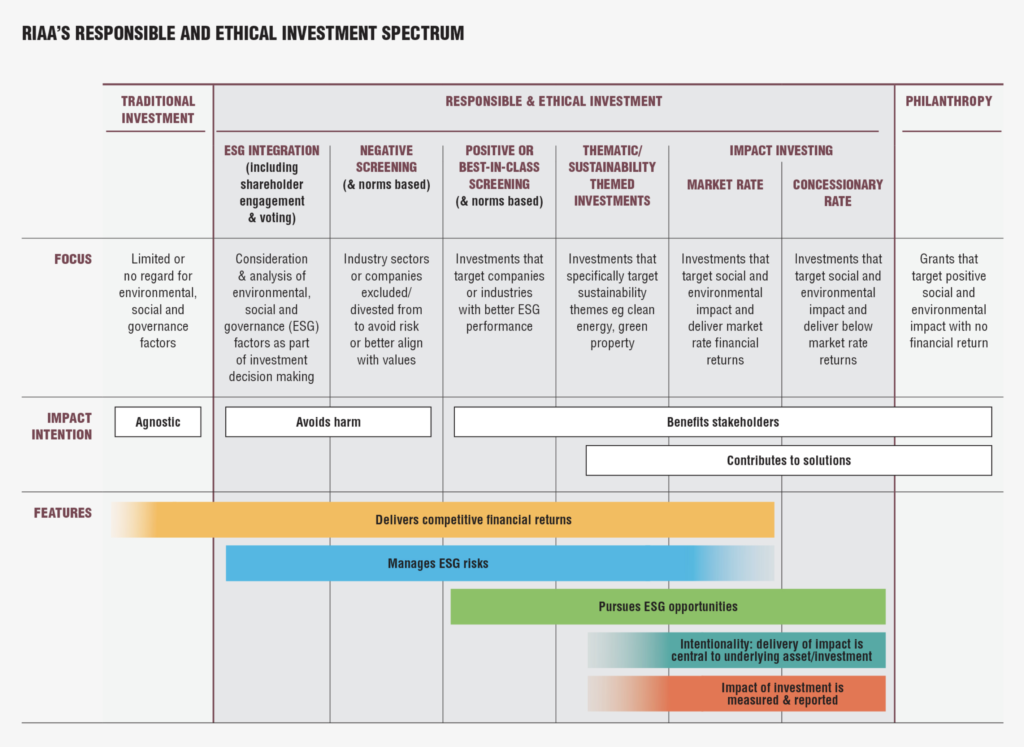

The responsible investment spectrum is wide ranging and can at times be confusing. This graphic from RIAA provides a simple visual explanation of the different investment strategies that come under the responsible umbrella.

RIAA Responsible and Ethical Investment Spectrum

The Responsible Returns search tool allows you to identify which two issues/concerns you’d most like to exclude from your investment:

Exclusions – Responsible Returns

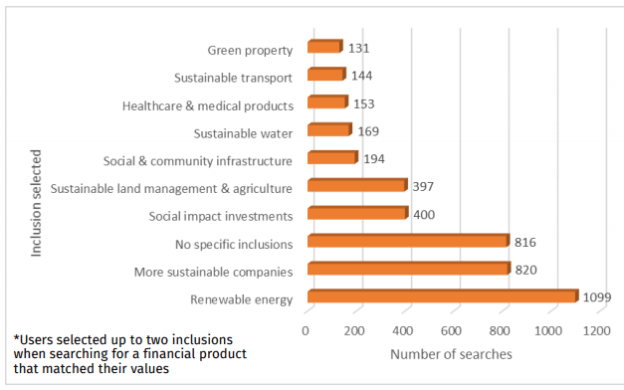

You can also select which two areas you would most like to focus on or include in your investment:

Inclusions – Responsible Returns

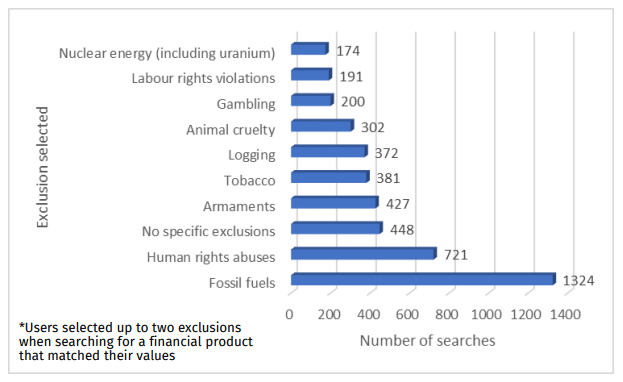

In 2018, a total of 2,818 searches were made using the Responsible Returns tool. Far and away the number one exclusion was fossil fuels, selected by almost half of those searching. This was followed by human rights abuses, no specific, armaments and tobacco.

Exclusions – Responsible Returns Activity Report 2018

Not surprisingly with fossil fuels the highest exclusion factor, renewable energy was the most searched positive inclusion. This was closely followed by more sustainable companies then no specific, social impact investments and sustainable land management and agriculture.

Navigating the responsible investment landscape can be tricky. As investors increasingly choose to align their investments with their values, new products are being launched to satisfy demand. The risk is whether investment funds are true to label or undertake ‘greenwashing’ to take advantage of investor interest. The Investment Spectrum and the Responsible Returns tool provide a useful starting point to investigate what may be suitable for you.

General advice warning: The advice provided is general advice only as, in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.