Market Overview

Asset Class Returns

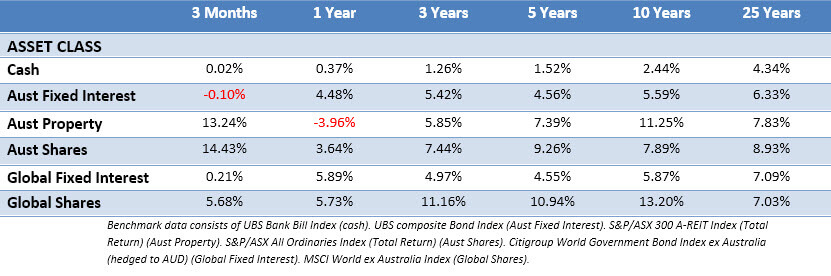

The following outlines the returns across the various asset classes to 31st December 2020.

Sharemarkets around the world offered positive returns in Q4 to ensure the year finished with modest gains, a position unthinkable to many after the rout of late February to mid-March.

US shares gained in Q4, with a strong November due to the vaccine developments. In addition to the vaccine news, Joe Biden’s win in the US presidential election, along with $900 billion stimulus package announced in late December proved to be positive developments. The Federal Reserve reinforced its supportive message, stating the current levels of quantitative easing will continue.

European shares gained sharply in Q4, again on the news of effective vaccines. Sectors that had previously suffered most severely through the pandemic, such as energy and financials, were the best performers. UK shares also performed well over the quarter reversing some of the underperformance suffered against other regions during early stages of the pandemic. The market responded well to November’s vaccine news and then again to the Brexit trade deal, with domestically-focused areas of the market outperforming.

Japanese share rallied in the quarter, driven from early November by vaccine-related news and the US presidential election result. Asia outside Japan also rallied strongly. South Korea was the best-performing index market, aided by strong gains from the tech sector. Indonesia, Taiwan, the Philippines and India finished ahead of the index.

Emerging market shares generated their strongest quarterly return in over a decade, with US dollar weakness amplifying gains. The rally in commodity prices was supportive of net exporters. China finished in positive territory, but lagged with the launch of an anti-trust investigation into Alibaba and further escalation in US-China tensions dragging on sentiment.

The Australian market posted a double digit return in Q4 with a strong performance from financials, energy, information technology and materials, with the big miners such as BHP, Rio Tinto and Fortescue posting strong gains off the back of a soaring iron ore price. In contrast, utilities continued to struggle.

2020 Lessons: Universal Truths

Uncertainty remains about the pandemic and the broad impact of the new vaccines, continued lockdowns, and social distancing. But the events of 2020 provided investors with many lessons, affirming that following a disciplined and broadly diversified investment approach is a reliable way to pursue long-term investment goals.

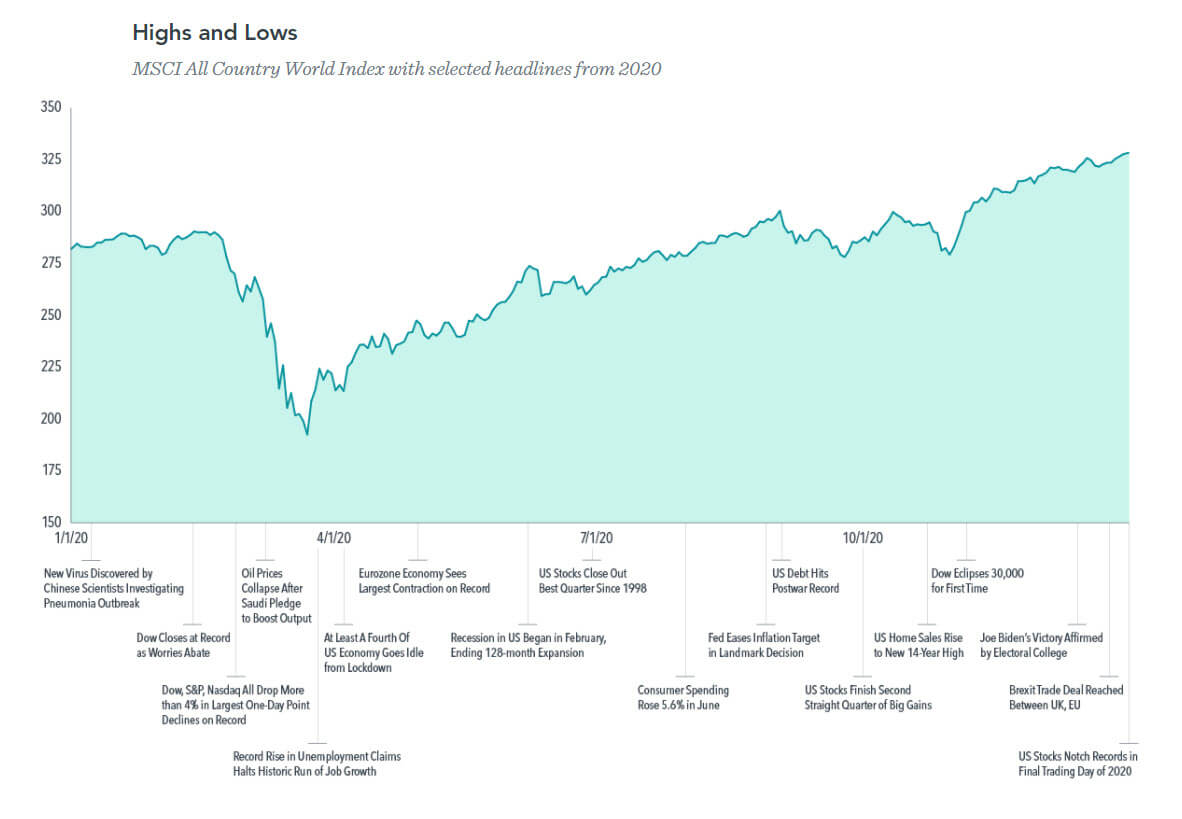

Market Prices Quickly Reflect New Information about the Future

The fluctuating markets in the spring and summer were also a lesson in how markets incorporate new information and changes in expectations. From its peak on February 19, 2020, the S&P 500 Index fell 33.79% in less than five weeks as the news headlines suggested more extreme outcomes from the pandemic. But the recovery would be swift as well. Market participants were watching for news that would provide insights into the pandemic and the economy, such as daily infection and mortality rates, effective therapeutic treatments, and the potential for vaccine development. As more information became available, the S&P 500 Index jumped 17.57% from its March 23 low in just three trading sessions, one of the fastest snapbacks on record. This period highlighted the vital role of data in setting market expectations and underscored how quickly prices adjust to new information.

One major theme of the year was the perceived disconnect between markets and the economy. How could the equity markets recover and reach new highs when the economic news remained so bleak? The market’s behaviour suggests investors were looking past the short-term impact of the pandemic to assess the expected rebound of business activity and an eventual return to more-normal conditions. Seen through that lens, the rebound in share prices reflected a market that is always looking ahead, incorporating both current news and expectations of the future into stock prices.

Owning the Winners and Losers

The 2020 economy and market also underscored the importance of staying broadly diversified across companies and industries. The downturn in stocks impacted some segments of the market more than others in ways that were consistent with the impact of the COVID-19 pandemic on certain types of businesses or industries. For example, airline, hospitality, and retail industries tended to suffer disproportionately with people around the world staying at home, whereas companies in communications, online shopping, and technology emerged as relative winners during the crisis. However, predicting at the beginning of 2020 exactly how this might play out would likely have proved challenging.

In the end, the economic turmoil inflicted great hardship on some firms while creating economic and social conditions that provided growth opportunities for other companies. In any market, there will be winners and losers—and investors have historically been well served by owning a broad range of companies rather than trying to pick winners and losers.

Sticking with Your Plan

Many news reports emphasized the unprecedented nature of the health crisis, the emergency financial actions, and other extraordinary events during 2020. The year saw many “firsts”—and subsequent years will doubtless usher in many more. Yet 2020’s outcomes remind us that a consistent investment approach is a reliable path regardless of the market events we encounter. Investors who made moves by reacting to the moment may have missed opportunities. In March, many panicked investors liquidated holdings. Then, over the six-month period from April 1 to September 30, global shares returned 29.54% and Australian shares 17.59%. A move to cash in March proved to be a costly decision for anxious investors.

Article courtesy of Mancell Financial Group. Additional material sourced from DFA Australia.

This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.