(This is adapted from a presentation Dave Rae gave to the Financial Planning Association member CPD webinar series)

Ethical and sustainable investing has become highly topical over the past 6 months. What has been happening?:

- Blackrock announced they will exit investments that “present a high sustainability-related risk” and divest $500M from coal-related businesses.

- EU has signaled that they will seek to impose carbon tariffs in trade deals with countries not meeting their global climate commitments.

- £30bn pool of pension funds in the UK is threatening to fire fund managers if they do not reduce climate risk.

- JP Morgan economists warn climate crisis is threat to human race

- “Climate change is increasingly seen as a material prudential risk.” – APRA

- “Today, climate change presents significant risks” – RBA

- “Directors should be able to demonstrate that they have met their legal obligations in considering, managing and disclosing all material risks that may affect their companies. This includes any risks arising from climate change, be they physical or transitional risks.” – ASIC

- Bushfires over the extended Australian summer have heightened the link between climate change and fossil fuels and the broader implications

- The COIVD crisis has highlighted social issues such as employee welfare, physical and mental health and community

And there are consumer trends that have been driving more sustainable choices in the way we live and spend money:

- Rooftop solar

- Electric vehicles

- Move towards less meat in diets and the rise of plant based and lab grown meat

- Plastic waste – reducing, replacing and cleaning up

- Slow fashion – sustainable threads, garment rental and 2nd hand

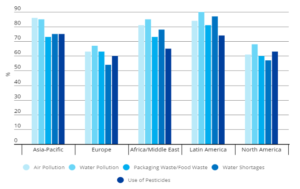

And consumers are expecting more from the companies they buy from. The Conference Board® Global Consumer Confidence Survey, conducted in collaboration with Nielsen Q2 2017 found that 81% of global respondents feel strongly that companies should help improve the environment.

The Conference Board® Global Consumer Confidence Survey/Nielsen Q2 2017

The 2030 Agenda for Sustainable Development was adopted by all United Nations Member States in 2015. It provides a shared blueprint for peace and prosperity for people and the planet, now and into the future. At its heart are the 17 Sustainable Development Goals (SDGs), which are an urgent call to action.

These are now being adopted by govt/businesses/NFP’s and many sustainable and impact funds as a tool to align their investment strategies.

And the Australian Sustainable Finance Initiative is developing a Roadmap for a sustainable and resilient economy and financial system – one that prioritises human well-being, social equity and protection of our environment. ASFI is following other countries around the world such as:

You can find Part 2 of this series here.