(This is adapted from a presentation Dave Rae gave to the Financial Planning Association member CPD webinar series) You can find Part 1 – here.

What is Ethical (or Sustainable) Investing?

ESG: Environmental, Social, Governance – the three pillars widely used to assess sustainable or ethical behaviours.

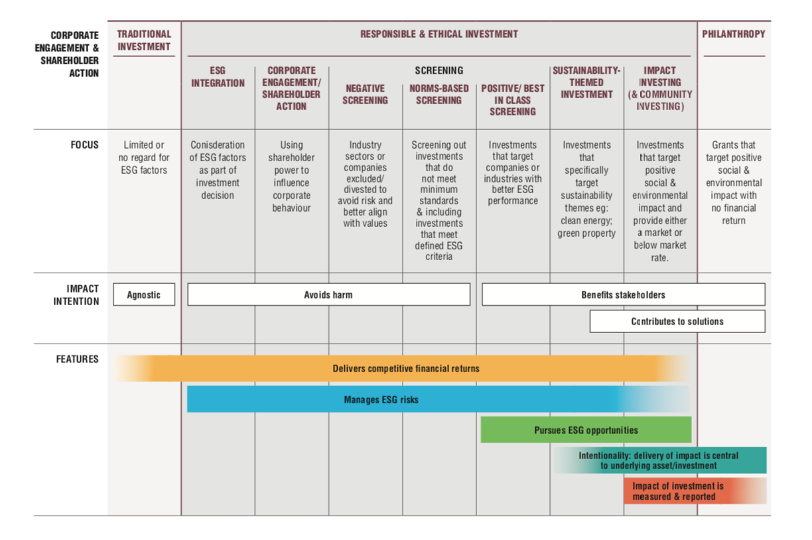

According to a 2019 Harvard Business Review article sustainable investing covers these common strategies:

- Negative/exclusionary screening (eliminating companies in industries or countries deemed objectionable )

- Norms-based screening (eliminating companies that violate some set of norms, such as the Ten Principles of the UN Global Compact)

- Positive/best-in-class screening (selecting companies with especially strong ESG performance)

- Sustainability-themed investing (such as in a fund focused on access to clean water or renewable energy)

- ESG integration (including ESG factors in fundamental analysis)

- Active ownership (engaging deeply with portfolio companies)

- Impact investing (looking for companies that make a positive impact on an ESG issue while still earning a market return)

Illustrating this further, the Responsible Investment Association Australasia (RIAA) uses this spectrum to explain where these strategies sit in comparison to traditional investments and philanthropy.

Source: RIAA

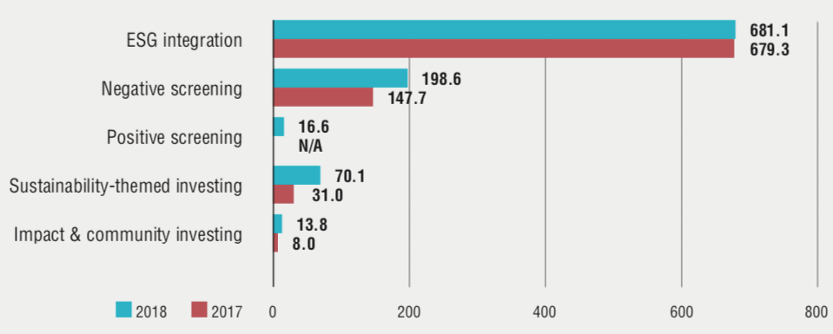

RIAA conducts an annual benchmark report to assess the size and state of the responsible investment market in Australia. The 2019 report broke down the Assets Under Management (AUM) by strategy:

Source: Responsible Investment Benchmark Report 2019 – RIAA

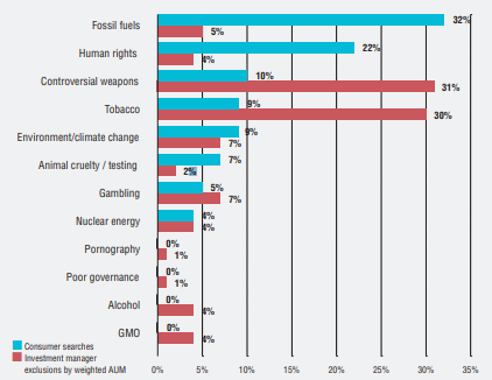

The benchmark report also analysed the most common negative screens – comparing those with the most consumer searches (according to RIAA’s Responsible Returns search tool) with the investment managers exclusions weighted by AUM. Interestingly, while fossil fuels are the most excluded by consumers they rank well behind controversial weapons and tobacco when it comes to issues excluded by funds.

Source: Responsible Investment Benchmark Report 2019 – RIAA

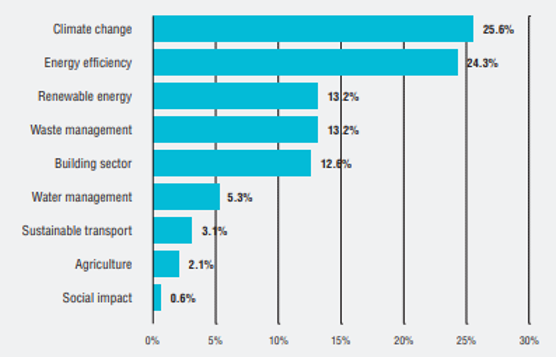

And looking at sustainable investment fund themes, climate change and energy efficiency are the most common based again on AUM:

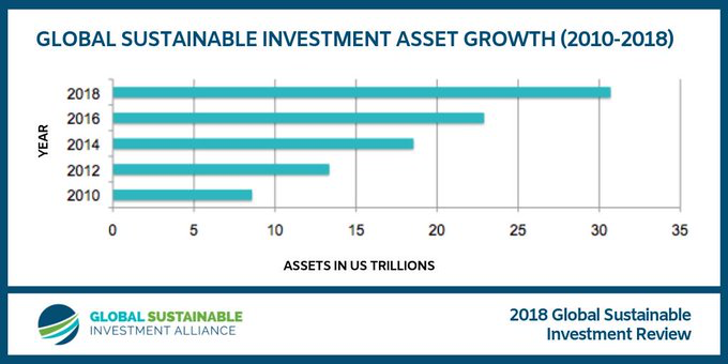

Lastly in Part 2, we take a look at the growth of the market globally. Globally sustainable investment AUM has been growing around 40% every 2 years:

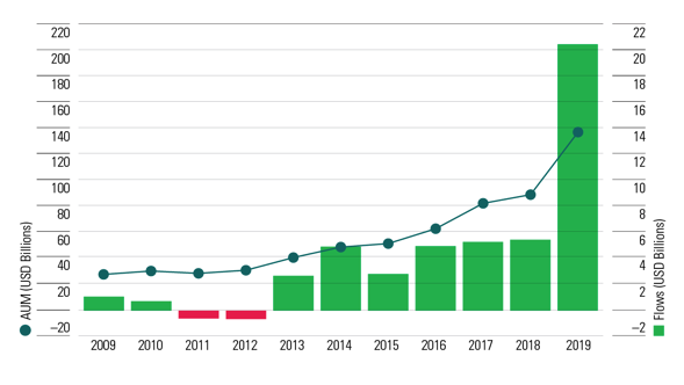

And recent growth in sustainable investment funds in the US has been sharply on the rise:

Source: Morningstar Direct. Data 31/12/2019

Dave Rae has many years of experience with investing your money ethically and sustainably. An expert in ensuring capital is aligned with a healthy society and environment, he is a member of several advisory groups which help Australians make financial decisions that are aligned with their ethical values.

Get in touch with us if you’re interested in aligning your money with your values.